If you are thinking about starting your own new business or investing in a business, then you should consider the concept of “crowdfunding.” You might have come across the term if you’ve done research about investments. Have you ever asked yourself what it means? Or whether it is something you can benefit from or not? In this article, you’ll find all the answers to your questions about the essentials of crowdfunding, especially in the real estate domain.

What Is Crowdfunding?

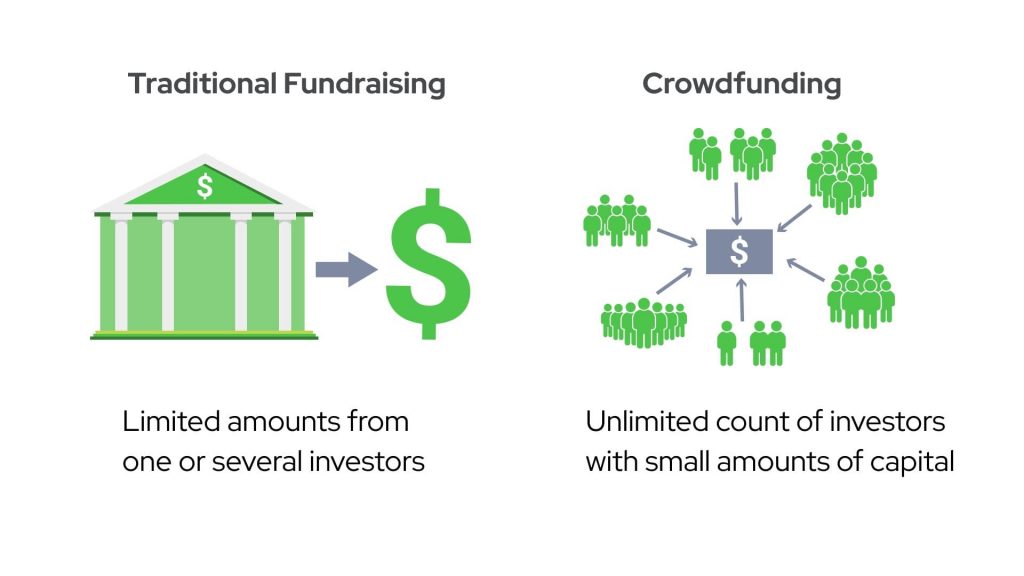

To kickstart our article, we will answer the question: what is crowdfunding? “Crowdfunding” is when a large crowd (hence its name) of people each contribute small amounts of capital that collectively constitute the funds of the business through licenced online crowdfunding platforms. The beneficiaries of such a method could vary from disaster relief campaigns to supporting artists to even real estate funding. But here we are going to exclusively talk about crowdfunding in the UAE’s real estate market. Normally, crowdfunding consists of three parties.

- The person raising the funds

- The party providing the crowdfunding platform

- The public providing funding through the platform

Crowdfunding in Dubai started in 2022 after the UAE cabinet approved crowdfunding for both private and public sectors. This was an initiative to support small and medium enterprises (SMEs) in the UAE. And it took a completely different path from traditional ways of funding. Here, participants, or as they are called, backers, are invited to invest capital in the business that builds its entire budget on the accumulation of backers’ investments. These backers can have a share of cash or stock in the emerging company.

How Does It Work?

Fundraising is regulated in the UAE and done through officially registered state-based channels. Debt-based funding, on the other hand, is a novel idea that is just now being deployed on a limited scale and has yet to be regulated and made widely available. The following organisations govern financial services or activities in the UAE:

- Central Bank of the UAE

- The Securities and Commodities Authority (SCA)

- Financial Services Regulatory Authority (FSRA) in Abu Dhabi

- Dubai Financial Services Authority (DFSA) in Dubai

Some crowdfunding projects include a perk, such as privileged access or discount when a product launches. People who are starting a crowdfunding campaign must set a fundraising target, which is often the sum required to launch the project. In essence, crowdfunding ends the back-and-forth between business owners and financiers. Entrepreneurs can directly approach the public with their offer to ask for financial support from those who are interested. In other words, there is a lot less time between having a concept and finding the money to make it a reality.

Crowdfunding In Dubai

The Dubai Financial Services Authority (DFSA) has unveiled what is said to be the first regulatory framework in the GCC for loan and investment-based crowdfunding platforms. With the adoption of the rule, all parties engaging in particular crowdfunding activities that offer financing options to small and medium-sized firms (SMEs) in the UAE will be licenced, organised, and protected in their rights and obligations.

What Are the Crowdfunding Investment Limits?

Generally speaking, anyone can invest in a regulated crowdfund offering; there are no restrictions. Investors are restricted in how much they can invest each year due to the dangers involved. Their annual income and net worth determine the maximum amount they are permitted to invest.

Benefits And Drawbacks

Based on what was previously stated in this article, you might be highly encouraged to dive into a crowdfunded business due to the prospect of the low overall risk of investment compared with the potentially high income. Due to the nature of this method, it could also give your services broad exposure and target huge audiences. It might also attract big investors to work with you in the same business and offer their expertise. On the other hand, there are still some cons to consider when considering crowdfunding. The absence of a well-schemed business plan can result in low success rates. It has high fees; it is restricted by strict rules, and it takes time and effort to get attention for your campaign.

Real Estate Crowdfunding Agencies in Dubai

In the real estate business, crowdfunding offers investors an opportunity to invest at a low cost in real estate, with an entry price that has a very low minimum. This investment can distribute and return a reasonable percentage of rental yields back to the investors. Some of the most prominent real estate crowdfunding agencies in Dubai are DubaiNext, SmartCrowd, Beehive and Eureeca, among others. The DubaiNext platform is a Dubai-government-launched platform that monitors its operations.

In conclusion, crowdfunding has opened new possibilities and new horizons for investment. Whether you think it is the new trend in the business world, or you have your own reservations regarding this method, crowdfunding continues to be one of the funding methods adopted by many new and thriving businesses. But crowdfunding is not the only way to invest in real estate in Dubai. You can consider other options, like Real Estate Investment Trusts (REITs). Have you thought about participating in a crowdfunded business before, or are you already a member of one? Share your ideas and experiences with us in the comments!