When looking for a venture to invest in, especially if you have the real estate market in mind, you will come across the concept of REITs. You may ask yourself what it is, and why should I invest in it? In this article, we are going to provide you with a comprehensive guide on what a REIT is, how it works, and all the necessary information to know about it.

What are REITs?

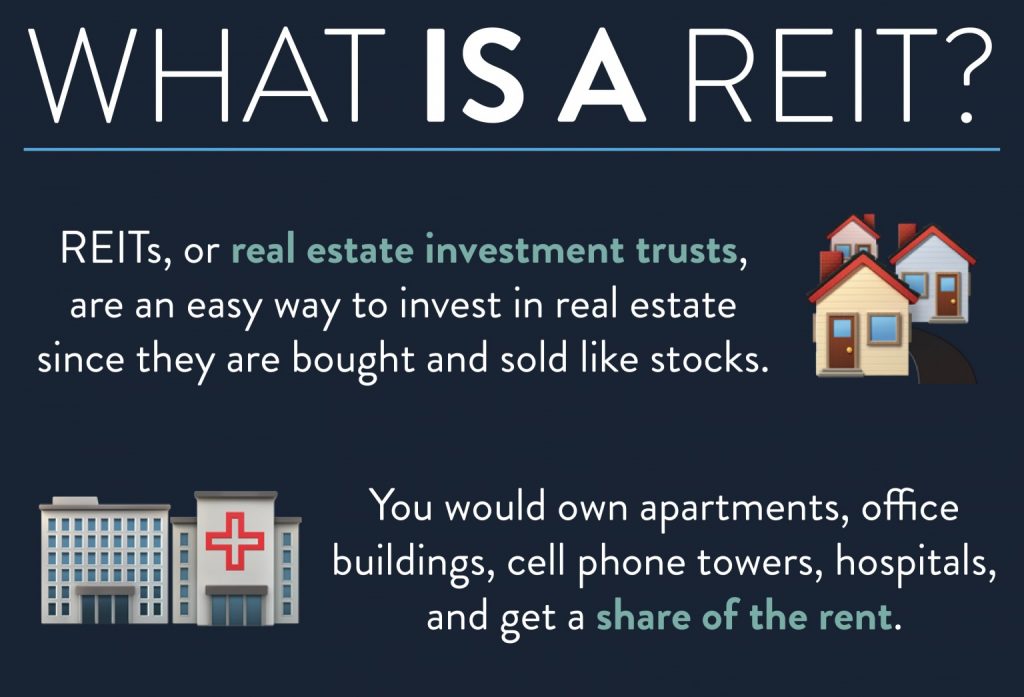

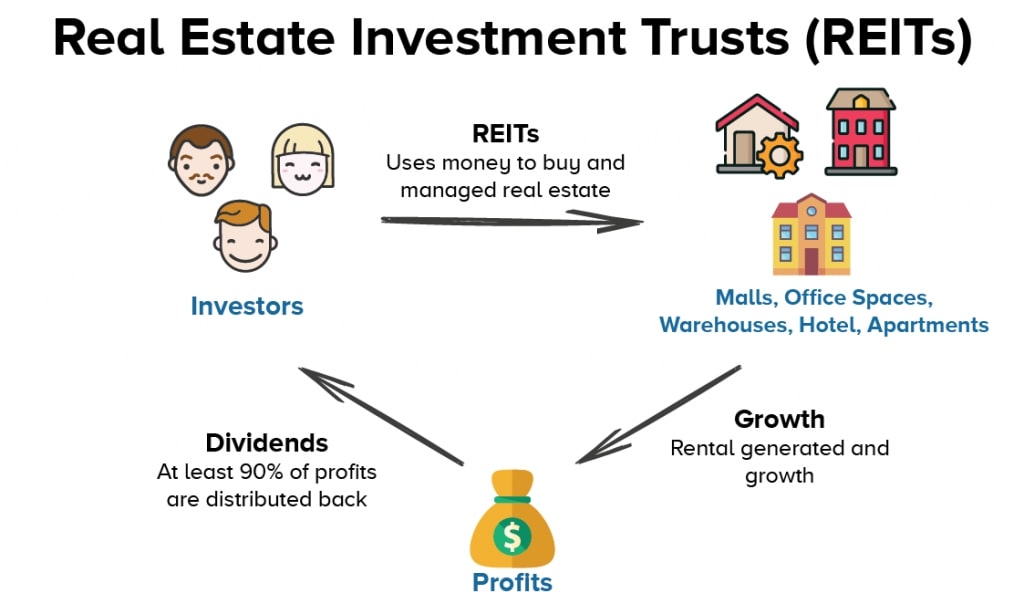

REITs, or Real Estate Investment Trusts, are companies that own, operate, or finance income-generating real estate. They provide a mutual fund that makes it possible for everyone, not only big investors, to benefit from valuable real estate. They give anyone the chance to invest in real estate through the purchase of individual company REIT stock. The REIT stockholders earn a share of the income without having to buy or manage the property. Real estate trusts usually trade on major stock exchanges and are total-return investments based on long-term capital appreciation with high and steady dividend income. They include interest, capital gains, dividends, and realised distributions.

How do REITs work?

REIT stock allows investors to buy shares in commercial real estate portfolios. Generally speaking, REITs specialise in a specific real estate sector. Nonetheless, there are diversified real estate trusts that may include different types of properties in their portfolios. Typically, real estate trusts are traded on major securities exchanges. Investors have the ability to buy and sell them exactly like stocks throughout the trading session. These REIT stocks usually trade at substantial volumes and are viewed as being very liquid instruments.

Types of REITs

REITs have three major types. They are Equity REITs, Mortgage REITs, and Hybrid REITs

Equity REITs

- Equity REIT investments are the most common and widespread type of REIT. They specialise in possessing and managing real estate that yields income. Revenues in this type of investment are mainly generated through rents as opposed to reselling properties of a different type.

Mortgage REITs

- Mortgage REITs are the most liable to be affected by interest rate increases. This is due to the nature of this type as it deals mainly with lending money to real estate owners or managers. Earnings here are acquired through the spread between the interest they earn on mortgage loans and the cost of funding these loans.

Hybrid REITs

- Hybrid REITs are, as the name suggests, a hybrid of both Equity and Mortgage REITs. They both own property and hold mortgages.

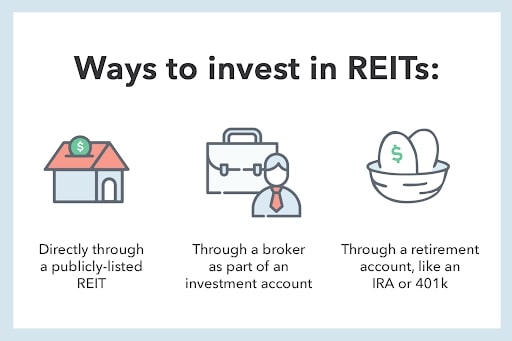

How to Invest in REITs

When you decide to invest in REIT stocks, you can choose between a REIT listed on major stock exchanges, a REIT mutual fund, an exchange-traded fund, public non-listed REIT stocks, or private REIT stocks. You can resort to a professional investment advisor or broker to help you analyse your financial objectives and recommend the most appropriate REIT investment for you to buy shares in. This doesn’t differ in essence from the typical purchase of stocks in any kind of business.

The Pros and Cons of Investing in REITs

In REIT investments, you can benefit from the high returns of real estate without the risk of a rapid, unexpected change of stocks, instead of sticking only to the more traditional way of only buying stocks. In addition, REIT stocks have the potential for a good return. An increase in real estate values is highly likely to happen in the long run, and REITs usually resort to using strategies to create additional value for their investments. On the other hand, REIT stocks also have some cons. High taxes, the influence of trends, potential high fees, and their long-term investment nature are some of their disadvantages.

REIT Agencies in Dubai

If you are looking to start investing with a REIT agency in Dubai, you can check agencies such as Emirates REIT, Tamleek REIT & Global Investments, Equitativa Dubai, and ENBD REIT.

Are you already an investor in a REIT, or are you planning to become one? Would you consider other options for investment, like crowdfunding? Share your ideas with us in the comments!